Tasting Room and Wine Club Study: Future of Tasting Rooms Positive, Sales Continue to Grow

Wineries are reporting their direct-to-consumer businesses thrived over the last year, despite new protocols, closures and reduced tasting room visitation. When we last reported results from the Tasting Room and Wine Club Survey in July 2020, there was some lingering hesitation on the ways in which tasting rooms would need to adapt and evolve—in fact, many were just starting to open back up after three months of forced closure.

This time around, the picture is looking a little brighter, as the respondents to our annual survey have shown that they were able to quickly and efficiently adjust practices to ensure strong sales and are generally optimistic about continued growth. Gone are the days of “desperate discounting” and aggressive case sales/shipping promotions. No doubt aided by continued efforts to open businesses back up, new technologies put in place to aid reservations and an eager public ready to return to normal, tasting rooms and wine clubs, particularly at smaller wineries, are flourishing. Many are even reporting that COVID-era practices like curbside pick-ups, hand delivery to locals and virtual experiences will continue, as an added value for customers.

Across the country, the average case volume sold direct-to-consumer was up 29.5 percent among our study respondents, and the average value of those purchases increased by 10 percent. The greatest increases were seen at small and mid-sized wineries, though large producers—which account for a huge amount of volume overall—saw decreases in sales.

This does not mean that the year was without its trials, nor does it imply that it’s smooth sailing from here. Wine club attrition rates might be shockingly low, but that could easily change should a swift recession befall us. Tasting room visitation was down but those guests who did show up purchased a lot of wine to make up for their missing counterparts.

Seated Tastings are de Rigueur

Over the years, the Tasting Room Study has asked how wineries conduct their tastings: are guests bellied up to the bar or seated in a lounge/at a table? We’ve watched as the number of tastings conducted while guests were seated increased—and so too did the average order value per sale. This year is no different: wineries conduct, on average, 68 percent of tastings while guests are casually seated, and 38 percent are done as more formal seated tastings.

“It’s a well-known fact that guests who enjoy a seated tasting tend to purchase more and be more likely to join the club,” said Meredith Hayes, director of DTC sales and marketing at Ram’s Gate Winery in Sonoma County. “I think many tasting rooms wanted to move into this model but weren’t able to for a variety of reasons. COVID pushed them to this change in business model and I find it unlikely that it’ll go back to “belly up to the bar” type tastings for many tasting rooms.”

Those thoughts were echoed by WISE Academy founder Lesley Berglund. She and her team have been developing tasting room programs and conducting training for sales staff for years and she knows the importance of a seated tasting, as it’s easier to plan staffing needs and will attract a higher-quality client. Like Hayes, Berglund also reported that COVID essentially forced many of these tasting rooms to move to the model, as they had to restrict the number of visitors, track those who did visit, and make the most of the guests who did arrive.

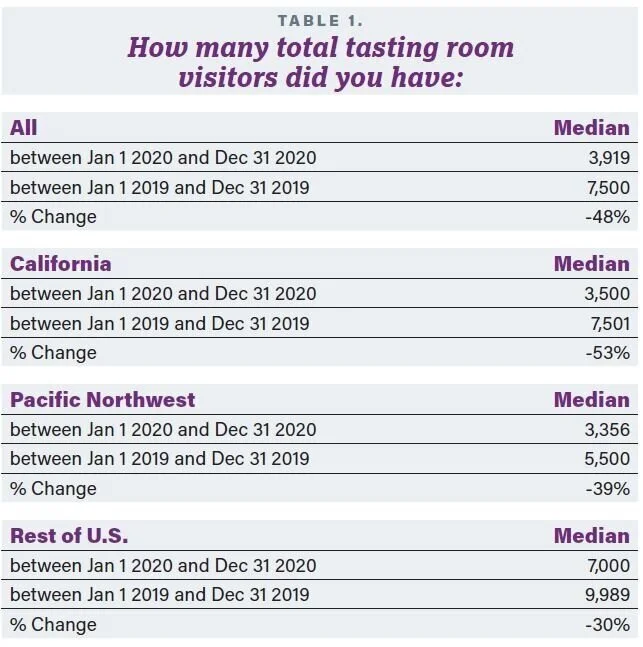

This last bit was the most important, as respondents overwhelmingly let us know that tasting room visitation was down across the country. California wineries had the largest drop—unsurprising considering how much tourism plays a role in wine country business (TABLE 1 ). While those in the Pacific Northwest saw a considerable drop as well, the rest of the country was able to more dependably rely on local foot traffic and out-of-state visitors within driving distance to make sales.

It was up to staff to convert the reduced number of visitors they had into larger wine sales, new wine club members and mailing list recipients. Across the board, wineries were able to convert, on average, 79 percent of visits to sales (up from 71 percent in 2019), 14 percent to wine clubs (down from 16 percent) and 41 percent to the mailing list (up from 35 percent). Those from wineries producing less than 5,000 cases had the highest conversion rates, as visitors looked to support nearby businesses (TABLE 2 ).

“Our tasting room sales are up which is great news. With the distancing requirements we are seeing fewer guests per day which allows our staff to have more quality time with guests. More time with guests leads to a better experience for the guest and higher sales for us,” said Hayes.

Enhanced guest experiences brought in a lot of dollars. In California, the average order value of a tasting room visit was $199, up from $123 last year. In non-West Coast states, that average increased to $119 from $52 in just a year. The Pacific Northwest held steady, at an $88 average sale.

Wine Clubs Save the Day

In a healthy wine club, the attrition rate will run about 20 to 25 percent—the rate at which a winery can reliably replace lost club members. In 2020, however, a median 10 percent attrition rate emerged, showing club members hung on through the year (TABLE 3 ).

“This saved our bacon,” said Berglund. From her discussions with tasting room and wine club managers across the country, she got the sense that a lot of members wanted to maintain a sense of normalcy and hang on to the small joys and pleasures, like wine shipments, and refused to opt out of clubs.

However, she doesn’t think that this very low attrition rate will hold. While nothing much has changed, or at least wildly differed, the fact that businesses are reopening and travel is resuming means that we can expect wine club sign up and attrition rates to return to more “normal” levels. It’s important to point out that the last financial crisis saw attrition rates around 40 to 45 percent. Should stimulus plans fail or the economy to take a turn, we could see higher attrition rates, though likely not as high as seen around 2010.

Of course, this matters because wine club members are valuable. Not only do they provide a steady, reliable cash flow, they spent $239 on average, up from $171 last year. Average wine club order values were up largely because of high sales in California, where the average was $328 in 2020 and $234 in 2019 and in non-West Coast states, which increased from $89 in 2019 to $115 in 2020. In the Pacific Northwest, however the average dropped from $251 in 2019 to $220 in 2020.

Between higher tasting room and wine club sales, many found their visitors were more educated or interested in wine in the last year.

“Personally, I’ve noticed that over the past year visitors seem to be more of the serious wine lover as opposed to the casual wine drinker,” said Hayes. “If you enjoy visiting wine country and learning/tasting about wine you still visited. If it was just an activity that was fun, but not a high priority you probably did other things. That could also have contributed to the higher sales. At Ram’s Gate we are currently seeing a good mix of club members and non-members.”

Websites, Virtual Experiences and Telesales Prove to be Money Drivers

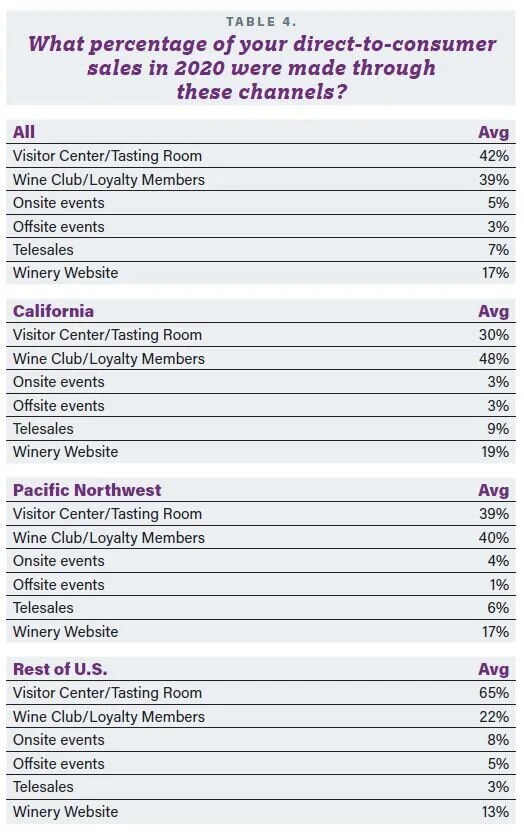

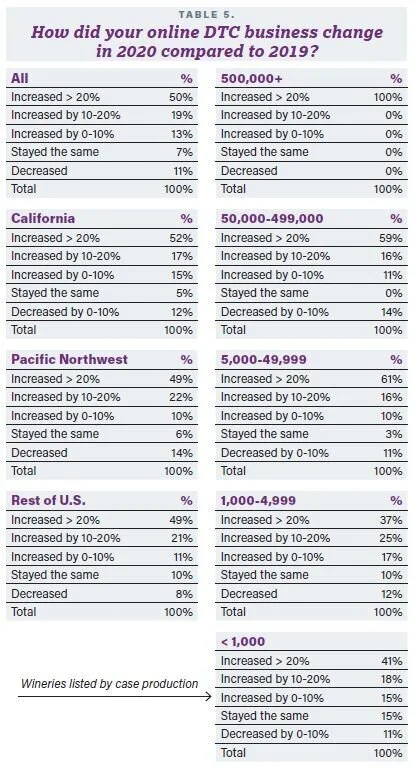

If there’s anything to learn from 2020, it’s that in-person direct-to-consumer sales are not the only way to move wine. In fact, to achieve some of the highest order values, it makes more sense to focus attention on the website. In 2020, average winery sales increased to $192, from $160 in 2019, and now account for roughly 17 percent of all winery DTC sales, according to the study.

Even when tasting rooms opened back up, many consumers knew that online ordering was a viable and convenient option, and they weren’t afraid to spend (Table 5). Over the years, we have consistently seen high average order values and Berglund says that wineries should enhance their web presences to allow seamless shopping experiences, further building sales.

“When left to their own devices [consumers] buy a lot of wine. We are suppressing the natural buying tendencies of our customers when we see them in person,” said Berglund.

It’s proof that it’s a channel worth investing time in, and something Ram’s Gate is looking into.

“Web sales have a lot more opportunity to grow. We are currently investing more in digital marketing and expanding our e-commerce program. We are also investing in other channels such as phone and considering other communication methods to help grow all aspects of the DTC business,” said Hayes.

In addition to web sales, wineries are increasingly diversifying their DTC sales channels. In 2020, telesales and virtual experiences became more popular options, though it would be inaccurate to call either “mainstream.”

Average order values for telesales saw an incredible increase, from $162 in 2019 to $210 in 2020. AOVs were particularly strong in California ($335), which isn’t surprising to Berglund. She said that these wineries have had programs in place for a longer period of time. Pacific Northwest wineries have started to implement programs or hire teams, and their AOVs have increased from $120 in 2019 to $137 in 2020. The rest of the country hasn’t made this much of a focus: AOVs in 2019 were just $20 and only increased to $33 in 2020.

Virtual tastings, now often called virtual experiences, continued to be an important sales avenue. The AOV for one of these interactions ran about $236 across the country. California, with its higher bottle prices led the way at $274, but the Pacific Northwest averaged a respectable $113 and the rest of the U.S. averaged an impressive $180 per tasting.

What the Numbers Say About the Future

Looking forward, the rest of 2021 is likely to be dominated by staffing shortages and extreme difficulty in bringing in new employees.

“Staffing is always a challenge. We offer a very competitive compensation package but are particular when it comes to hiring someone who will embrace our culture and thrive,” said Hayes. “We look for people who understand the balance between providing excellent service, relating our story and highlighting what makes us special as well as teaching them about our wines and closing the sale.”

Judging by the number of postings on winejobs.com for TR and hospitality sales staff , there will be some stiff competition for a limited talent pool. While the data to support these reasons is lacking, there are a number of guesses floating around that attempt to explain the small number of applications: people are making more on stimulus-enhanced unemployment benefits than they would working, parents are choosing to stay home until day care centers and schools fully open, a general lack of desire to work in hospitality/serving positions among the public and, of course, poor pay. It’s too soon to know officially which is the main driver, or the extent to which any of these guesses played a role, but many in the wine business are looking at compensation and whether it is sufficient to bring in new talent.

We have asked how wineries pay their tasting room employees for years. While there have been increases to wages since the last year, it’s often the average base pay that can be off-putting (Table 6). In many parts of California, a $20 per hour wage simply isn’t enough to live by, at least not in wine country.

Total and incentive compensation packages are going to be a key part of attracting employees back to tasting rooms, as well as clever and unique recruiting. In some cases, managers will need to make a tough decision between finding the right talent or simply hiring whomever they can find.

At the end of the day though, the results show that wineries are still optimistic about tasting room and club sales and, while the growth may not be as high and will certainly not be permanent, it seems that most are sure that the rest of 2021 will be bright.

Methodology

2021 Wine Business Monthly Tasting Room and Wine Club Study. The WBM study was conducted between March 9 and April 5, 2021. For a subset of questions, the sample results were blended with anonymized data from Community Benchmark.

The survey participants include tasting room and direct to consumer management, as well as owners and marketing management at wineries with tasting rooms throughout the US. From a total universe of 11,000 wineries. The responses were structured to enable reporting by winery size (annual production) and geographic location, allowing us to accurately report activities of the total market. Accepted statistical techniques are employed to allow segmentation as indicated in the data presented.